Lane Transit Tax updated

Effective 1 January 2022, the Lane Transit Tax rate increased from 0.76% to 0.77%.

https://www.ltd.org/payroll-self-employment-tax-information/

Oregon State Unemployment Tax updated

Effective 1 January 2022, the Oregon State Unemployment Tax wage base increased to $47,700 from $43,800.

https://www.oregon.gov/employ/businesses/tax/pages/current-tax-rate.aspx

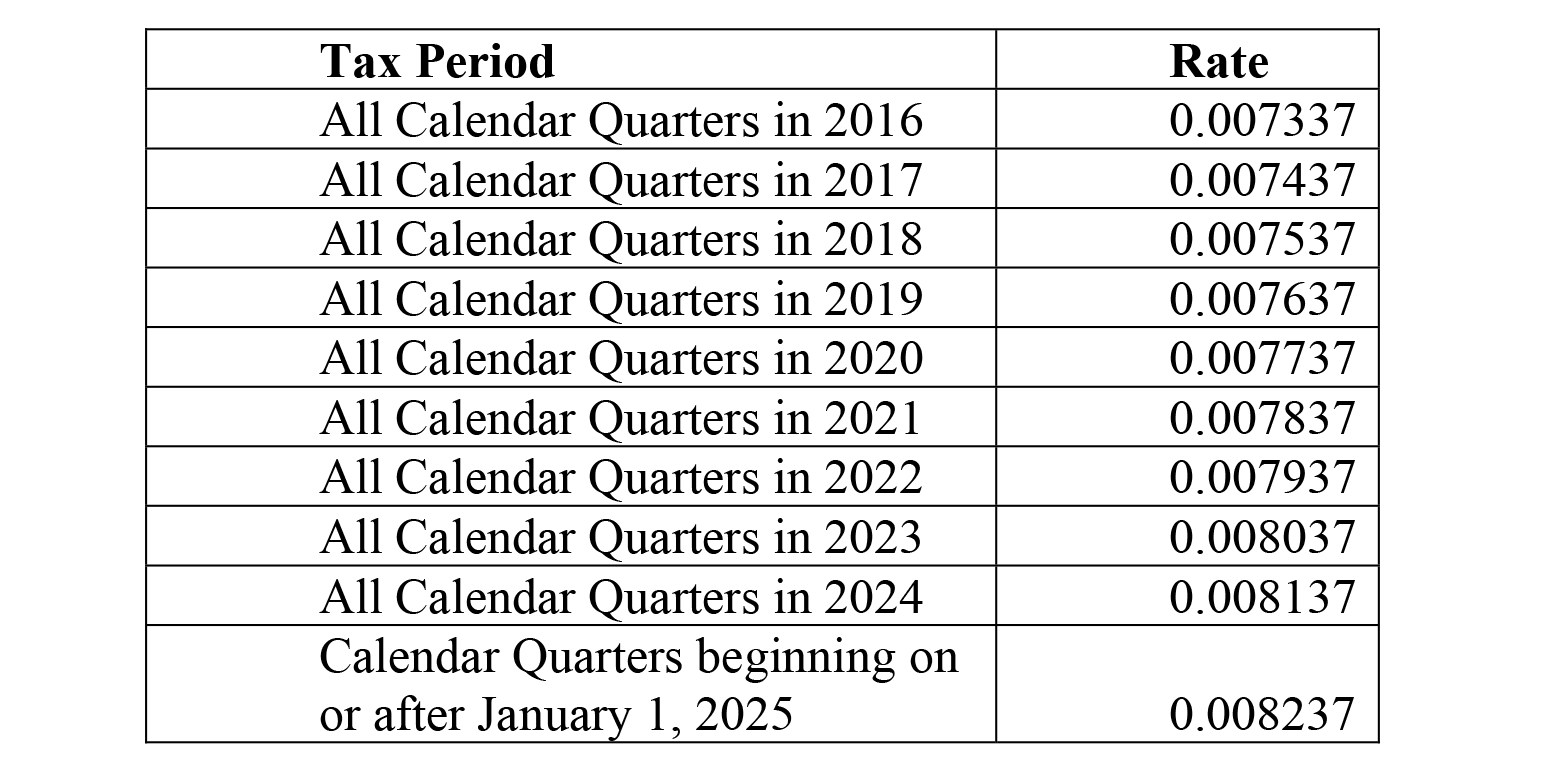

TriMet Excise Tax updated

Effective 1 January 2022, the TriMet Excise Tax rate increased from 0.7837% to 0.7937%.

https://trimet.org/pdfs/code/TriMet_Code_Chapter_13.pdf

Legislation Updates 2022

Workers’ Compensation parameters corrected

When setting up the employee and employer Oregon Workers’ Compensation taxes in the engine, jurisdiction data set for the employee tax will no longer override data for the employer tax. For example, when setting the employee tax as exempt (isExempt is true), the employer tax will no longer return $0.

Because jurisdiction data is now assigned separately, you must set each tax separately. You should no longer set only the employee or employer portion when computing both if you were doing that in your system.

Note: This change only affects clients using STE2-style code or the STE Web API. Clients using the legacy STE1-style code who wish to set the employee and employer portions separately may do so using STE2-style code. STE1-style code does not support setting the employee and employer portions separately.